Some Of Non Profit Organization Examples

Wiki Article

Things about 501 C

Table of ContentsSee This Report on Npo RegistrationAn Unbiased View of 501c3Some Known Details About Non Profit Org The Basic Principles Of Non Profit Organization Examples The 15-Second Trick For 501 CSome Known Factual Statements About Google For Nonprofits The Definitive Guide for 501c3 OrganizationSome Ideas on Non Profit Organization Examples You Should Know501c3 Nonprofit Can Be Fun For Anyone

Integrated vs - 501c3. Unincorporated Nonprofits When individuals think of nonprofits, they typically assume of incorporated nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, and also other formally created companies. However, numerous people participate in unincorporated nonprofit organizations without ever understanding they've done so. Unincorporated nonprofit associations are the outcome of 2 or even more people working together for the objective of providing a public benefit or service.Exclusive structures might include household foundations, personal operating foundations, and business structures. As kept in mind over, they generally don't use any kind of solutions and also instead use the funds they elevate to support other charitable companies with service programs. Personal foundations also tend to need more start-up funds to establish the company in addition to to cover legal costs and also various other continuous costs.

9 Simple Techniques For 501c3 Nonprofit

The properties remain in the depend on while the grantor lives and the grantor might take care of the properties, such as acquiring and marketing stocks or genuine estate. All properties deposited into or acquired by the count on stay in the count on with income dispersed to the designated recipients. These trusts can make it through the grantor if they include an arrangement for continuous management in the paperwork used to establish them.

The Best Strategy To Use For Google For Nonprofits

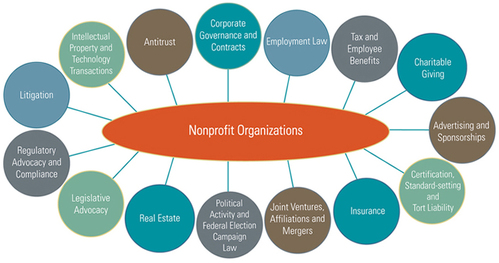

Additionally, you can employ a trust fund attorney to help you produce a philanthropic trust as well as advise you on how to handle it moving on. Political Organizations While a lot of other forms of not-for-profit companies have a minimal capacity to take part in or supporter for political task, political companies run under different regulations.

Non Profit Org - Questions

As you evaluate your alternatives, make our website sure to consult with a lawyer to figure out the most effective strategy for your organization as well as to guarantee its correct arrangement.There are numerous types of nonprofit organizations. All assets as well as revenue from the nonprofit are reinvested into the organization or donated.

The 8-Second Trick For Non Profit Organizations Near Me

Some instances of widely known 501(c)( 6) companies are the American Farm Bureau, the National Writers Union, as well as the International Organization of Satisfying Coordinators. 501(c)( 7) - Social or Recreational Club 501(c)( 7) companies are social or leisure clubs.

About Irs Nonprofit Search

501(c)( 14) - State Chartered Credit Scores Union as well as Mutual Get Fund 501(c)( 14) are state chartered credit history unions as well as common book funds. These organizations provide Get the facts monetary solutions to their participants and also the area, usually at affordable prices.In order to be eligible, at the very least 75 percent of members need to be present or previous participants of the United States Army. Funding comes from donations and also government grants. 501(c)( 26) - State Sponsored Organizations Offering Health And Wellness Protection for High-Risk People 501(c)( 26) are nonprofit companies developed at the state degree to offer insurance coverage for high-risk people who might not have the ability to get insurance coverage through other methods.

Not known Facts About 501c3

501(c)( 27) - State Sponsored Workers' Settlement Reinsurance Organization 501(c)( 27) nonprofit organizations are produced to give insurance policy for employees' compensation programs. Organizations that provide employees compensations are required to be a member of these companies as well as pay fees.A nonprofit company is a company whose purpose is something besides making a profit. irs nonprofit search. A not-for-profit contributes its income to attain a particular goal that benefits the public, rather than dispersing it to investors. There more than 1. 5 million not-for-profit companies registered in the US. Being a not-for-profit does not imply the organization will not earn a profit.

A Biased View of 501c3 Nonprofit

No one person or group possesses a not-for-profit. Properties from a not-for-profit can be sold, but it benefits the whole organization instead of individuals. While any person can integrate as a not-for-profit, just those that pass the rigid requirements stated by the federal government can accomplish tax obligation excluded, or 501c3, standing.We talk about the steps to coming to be a not-for-profit additional right into this web page.

Fascination About Google For Nonprofits

One of the most crucial of these is the capability to acquire tax obligation "exempt" condition with the internal revenue service, which enables it to obtain contributions devoid of gift tax obligation, enables benefactors to subtract donations on their pop over to this web-site tax return and also exempts a few of the company's tasks from income tax obligations. Tax excluded condition is essential to lots of nonprofits as it encourages contributions that can be made use of to sustain the goal of the company.Report this wiki page